2022 Results

2022 Business report

2022 Results

A record year for Relyens

These excellent results can be attributed to the diversification of our risks, activities and customer base that has been underway for several years, particularly in Europe. The Group has thus consolidated its position as leader in statutory risk insurance in France, and as leader in medical liability insurance in France, Spain and Northern Italy.

“For the first time in our history, we passed the billion-euro mark for premiums collected. This marks an important milestone for our Group, particularly as this growth was achieved in a less favourable macroeconomic context, in markets where competition has never been so strong and where the challenges and stresses for our customers are great. A number of indicators are pointing in the right direction: our position and growth in Europe, our controlled business model, our initial encouraging results for our risk prevention and management solutions for healthcare professionals in Europe and local authorities in France, and our solvency and profitability – all major factors in the long-term future of our Group. While 2023 remains a high-stakes year during which we will have to continue our transformation, we can collectively congratulate ourselves on these very good 2022 results. They are recognition of the transformation of Relyens’ business model and its capacity for innovation in recent years, positioning us not only as an insurer for our customers and members, but also as a manager of their medical, cyber and HR risks.”

An increase in premiums collected

since 2021

BREAKDOWN OF GROUP PREMIUMS BY RISK

BREAKDOWN OF GROUP PREMIUMS COLLECTED BY CUSTOMER TYPE

HEALTHCARE - SOCIAL SERVICES

REGIONAL PLAYERS

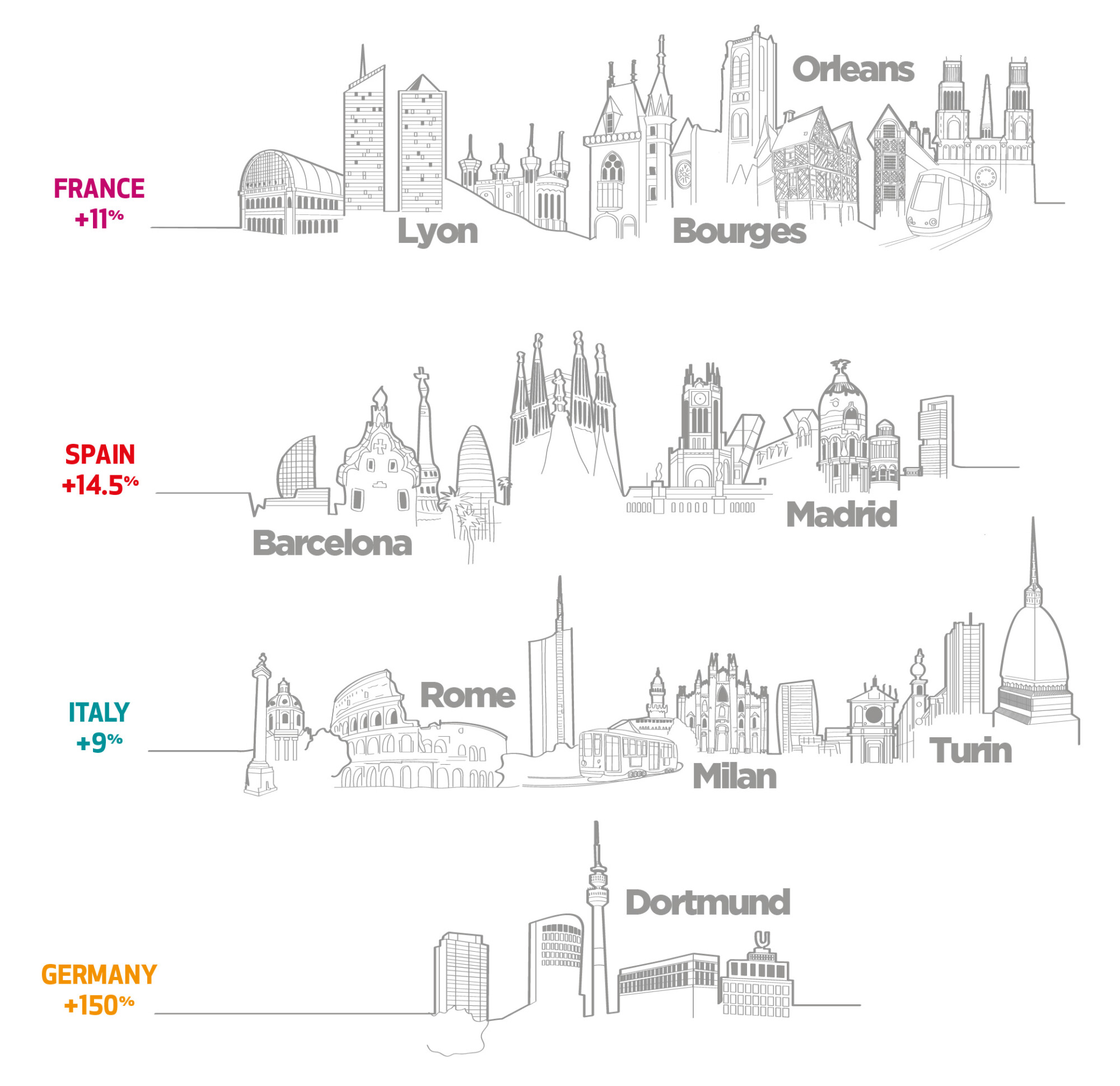

An increase in turnover for all countries where the Group is present.

The evolution of turnover follows the same trend, amounting to €581 million compared to €521 million in 2021, representing a growth of +11.6% driven by all the Group’s activities. Insurance activities contribute predominantly to the turnover, followed by brokerage and services. The year 2022 also marks the initial marketing of our risk prevention and management solutions, with the sales contributing to the increase in turnover.

All countries where the Group is present have contributed to the growth of the overall turnover through the acquisition of significant contracts.

SALES BREAKDOWN

NET INCOME

The technical margin continues to improve in 2022 as a result of the balanced pricing strategy for Liability Insurance in France, which has been implemented for over 3 years, a rigorous and cautious underwriting policy in Italy and Spain, and the management work carried out by the indemnity teams.

The high inflation observed in Europe and worldwide since the beginning of 2022 has led the Group to record additional provisions to anticipate the increase in claims costs.

A high financial result

The consolidated financial result of €74.8 million is lower than in 2021 (€83.1 million), but it remains very high considering the context of rising interest rates and declining stock markets observed in 2022. As a reminder, in 2021, the result of Relyens Innovation Santé, an investment subsidiary of Relyens Mutual Insurance in healthcare development capital, had made a significant contribution to Relyens’ consolidated result. Compared to the previous year, the lower performance of these portfolios is offset by higher real estate income (capital gain from the sale of an office building called “Be” located in the business district of Part-Dieu in Lyon).

Strengthened equity and solvency

GROUP SOLVENCY RATIO

Relyens also sees its model and financial strength confirmed in 2022. The Group’s financial performance is also reflected in its solvency ratio. Supported by the rise in interest rates, it shows a significant improvement and amounts to 199% for the year 2022, an increase of 18 points compared to 2021 (181%).

The financial rating agency AM Best has confirmed our A- rating with a stable outlook for the 8th consecutive year, applauding the robustness of our model, the strength of our balance sheet, and our financial performance. AM Best has also highlighted the Group’s innovation strategy by positioning Relyens among the most innovative players in the insurance sector.

Extra-financial performance

In line with our mission and the United Nations’ sustainable development goals, our Group relies on an investment policy that is meaningful and aligned with our values, reconciling performance and long-term risk management. In 2022, we implemented a responsible investment charter and committed to measuring the extra-financial performance of these investments We exclude from our investments any controversial companies that would tarnish our commitment as a responsible investor.

Find out more